As a first-time entrepreneur, you don’t have to worry if you’re weak at finance and accounting. You only really ever need to care about cashflow as a financial metric while operating a small enterprise.

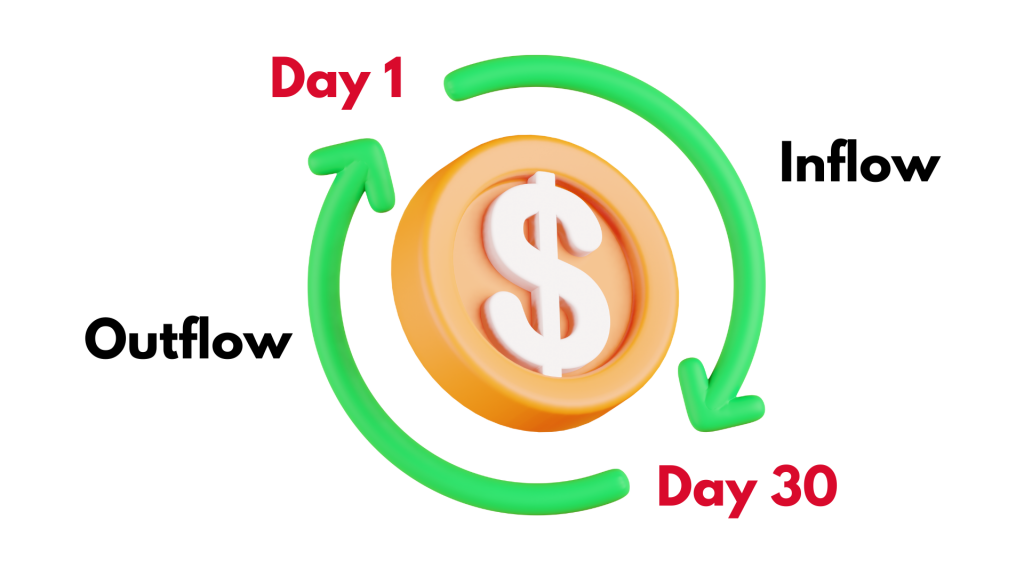

Monthly Cashflow: Money coming in (inflow) vs money going out (outflow) in a month

If more in than out, you’re cashflow positive. You’re setup for success! Invest your profits back into your business wisely while you still can. Leaving cash in the bank is a bad idea if you can predict positive cashflow for a certain month-over-month time period with high confidence.

If more out than in, you’re cashflow negative. You’re losing money and you only have a certain time period before you run out of operating expenses. You’re dying. Do everything necessary to become cashflow positive predictively.

Side note, as an entrepreneur and an investor, I like to build and invest in pre-seed stage startups that have hopes of securing recurring revenue through subscription-based business models. The more customers that subscribe, the more cash can come in each month predictably.

Also, there is more comfort in re-investing into the business knowing it’s not feast or famine like in the service business. Hence, businesses that have built up predictable positive cashflow through recurring revenue are valued more globally and are also easier to sell.