As an entrepreneur, involving PEIs in your company can be tempting. But, we are yet to figure out how much percentage of our company are we willing to give to the PEI for a certain sum of money. In simple words, deciding the “valuation” of a company. In this final part of this series, we will discuss valuation techniques and processes involved in the valuation of a company.

What Is Company Valuation And Why Is It Needed?

Company Valuation means the value of equity of a company. According to the amount of investment made by the Private Equity (PE), the equity value is calculated. The equity value determines the capabilities of the PEI to affect the governance of the company. We need to transform the investment into private equity value. This calculation can be done in different ways.

How Is Private Equity Value Calculated?

For corporate financing, there are solid and common rules during the valuation of a company. In this process, it becomes important to calculate the private equity value at two moments: while receiving investment and while the PE exits.

The private equity value at the time of investment and the time of exit determines the IRR (Internal Rate of Return) of the investment. For maximizing profit, the PEI has to try and minimize the equity value while investing and maximize the value while exiting.

The most common method to calculate the equity value of a company is called Discounted Cash Flow (DCF). In this approach, the present value of an investment is calculated by estimating the future cash flows discounted at the Weighted Average Cost of Capital (WACC). The term “present value” here is the current value of a sum of money in the future which is always less due to inflation.

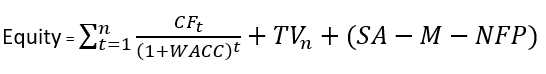

The general formula to estimate the equity value for investment after an arbitrary time n:

where,

1) Cash Flow (CF)

The cash flow of a company in a period of time is calculated as:

EBIT – Income Taxes + Depreciation -Increase in net working capital – Capital Expenditure

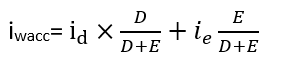

2) Weighted Average Cost Of Capital (WACC)

The idea to calculate WACC is to calculate the total amount of liabilities in a company and its formula is:

Where,

id=net cost of debt

ie=net cost of equity

D = debt

E = Equity

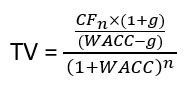

3) Terminal Value (TV)

Terminal Value is the value of the business after a forecasted period of time. It assumes that the business will grow at a set growth rate after the forecast period. It is calculated as:

Where,

g= perpetual growth rate

4) Other Factors

SA = Surplus/ Non-operating assets

M = Minority

NFP = Net Financial Position

The Enterprise Value (EV)

The total value of a company is its EV. The following part of the formula represents the enterprise value of a company:

EV is not affected by the liabilities of a company.

The DCF method is generally used along with multiples.

What Are Multiples?

Imagine buying a house. You obviously can calculate the value of a flat by different methods but you also want to analyze similar transactions happening around the area before estimating the value of the house. Similarly, by using multiples, we mean to calculate company valuation according to DCF along with average equity values of similar transactions. The commonly used multiples are:

1) Enterprise Value/ Earnings Before Interest, Taxes, Depreciation, And Amortization (EV/EBITDA)

The number of times you should multiply EBITDA to buy a company. It represents the firm’s capability to produce gross margin.

2) Enterprise Value/Earnings Before Interest And Taxes (EV/EBIT)

The number of times you should multiply EBIT to buy a company. It represents the capability of the firm to generate an operating profit.

3) Enterprise Value/Sales (EV/S)

The number of times you should multiply the sales to buy a company. It represents the capability of a firm to produce sales.

Now that we have multiples out of our way, let’s get back to the formula and analyze the factors affecting the equity value,

The Venture Capital Method (VCM)

In the cases discussed till now, there is a solid business plan, the future of the company can be predicted and the DCF method can be used to estimate the equity value. What if there isn’t any evidence of a solid business plan which is common in the cases of seed financing or startup financing? Here, we use the VCM to estimate equity value.

VCM typically focuses on the expected IRR, rate of growth of the firm, and percentage of shares the PEI has to buy to be an active decision-maker in the company. This method consists of a series of crucial steps which are generally carried out:

1) Future Value Of Investment

This step involves the calculation of the future value of an investment using key factors like expected IRR and holding time. The general formula to calculate the future value of the investment is:

Future Value of the Investment = Value of the Investment x (1 + Expected IRR)n

Where n=holding period in years

2) Calculation Of TV

The terminal value is calculated with the help of the P/E ratio as,

TV = Value N Net Income x PE Ratio

3) Percentage Of Shares

The percentage of shares of PE is calculated as,

Percentage of PE shares =Future Value of the Investment / TV

4) Number Of Shares To Be Issued

The company issues a certain number of shares which can be calculated as,

Number of shares = Existing Shares x (percentage of shares) / (1 – the percentage of shares)

5) Value Of Newly Issued Shares

This process involves the calculation of the value of newly issued shares of the company and the value can be calculated as,

Price of newly issued shares = Value of investment / Number of shares

Bottom Line

As a first-timer in the PEI or the entrepreneurs’ world, deciding the value of a company can seem confusing. We hope this article has helped you with that.

Thank you for following this series up to the end. Please let us know in the comment section if you have queries on any of the topics mentioned in the series and we will do our best to help you.